Welcome to xaigate

Best Crypto Payment Gateway for Businesses

XAIGATE is a secure and user-friendly crypto payment gateway that allows businesses to accept cryptocurrency payments from customers around the world. With XAIGATE, businesses can easily integrate cryptocurrency payments into their existing websites or online stores.

A Secure and User-Friendly Crypto Payment Gateway

E-commerce

Easily Set Up Your Online Store with Crypto Payment Plugins

Invoicing Feature

Create and customize invoices to send to your customers and accept cryptocurrency payments in return.

Fast and secure payments

XAIGATE offers fast and secure cryptocurrency payments.

Real People. Real Relationships.

The best cryptocurrency payment processors are services that allow businesses to accept cryptocurrency payments from customers all over the world. They act as an intermediary between consumers and merchants, converting cryptocurrency payments into any currency forms of choice and depositing them into sellers’ bank accounts.

Happy Client

Merchant

Official Partner

Country

About XAIGATE

The Best Crypto Payment Gateway Processor

XAIGATE is a comprehensive cryptocurrency payment gateway that offers businesses everything they need to start accepting cryptocurrency payments. With its secure, user-friendly, and reliable features, XAIGATE is a valuable addition to any business that wants to accept cryptocurrency payments and expand their customer pools.

XAIGATE is known for supporting a vast array of cryptocurrencies, making it an attractive option for businesses looking to accept a diverse range of digital assets. It offers plugins for various e-commerce platforms, fiat conversions, and additional services like crypto wallets.

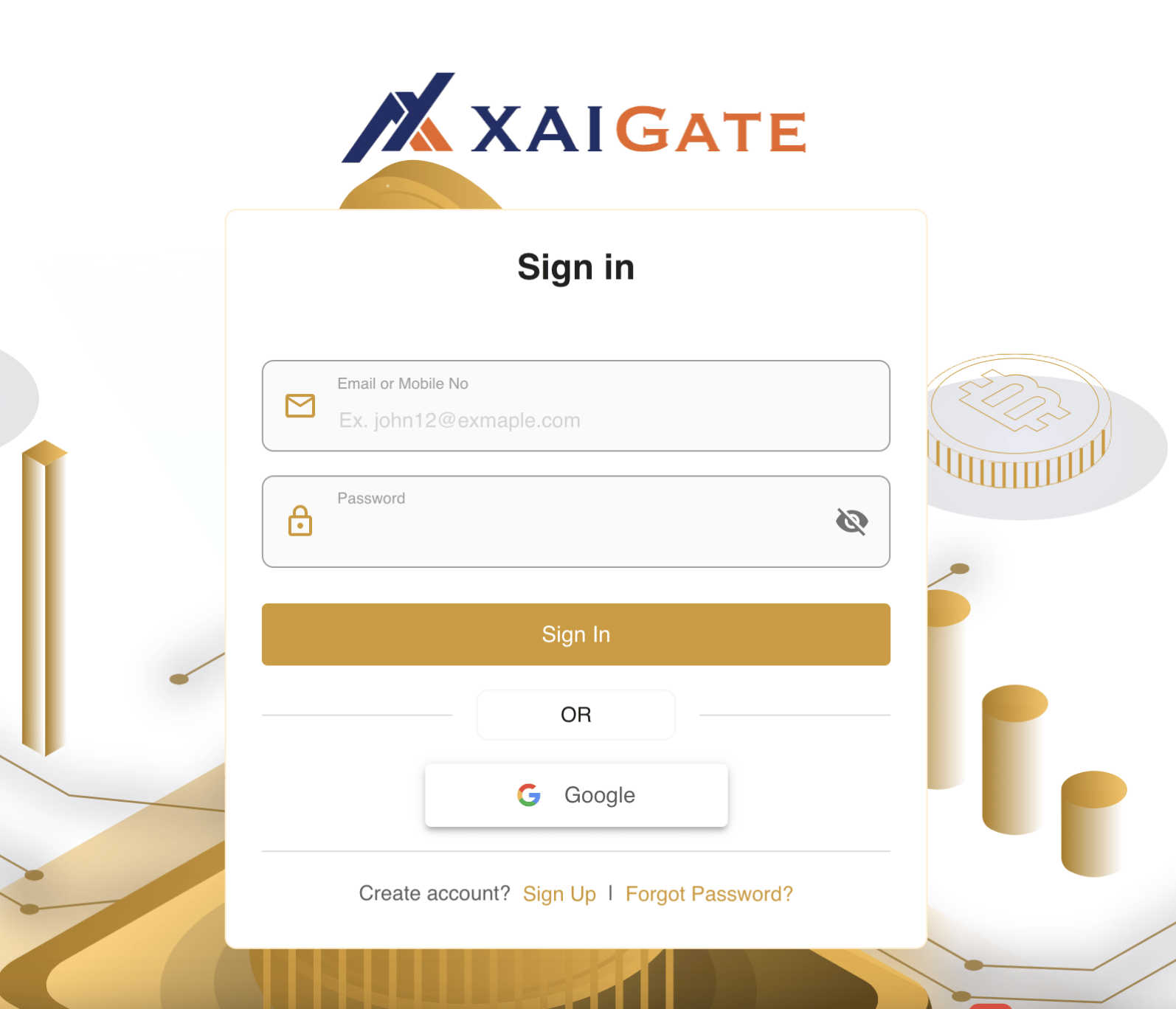

If you are a business owner who is looking to integrate a cryptocurrency payment gateway into your workflow, XAIGATE is the perfect solution for you. Sign up for a free trial today and start experiencing the benefits of cryptocurrency payments firsthand.

Key Features and Benefits

Smart Solution for Cryptocurrency Payment Gateway

Low Crypto Processing Fee

XAIGATE charges competitive fees on cryptocurrency transactions. This is a valuable feature for clients who want to save money on processing fees.

No Monthly Cost

With our service, you can enjoy the peace of mind that comes with knowing that there are no monthly fees.

Easy to Setup

You don't need any technical expertise to set up our service. We provide clear and concise step-by-step instructions to help you set up our service.

Invoice Services

Generate easy and dynamic invoices to request payments, even for payments processed by XAIGATE's blockchain API.

Global Payments

XAIGATE accepts cryptocurrency payments from customers all over the world. This can help businesses expand their global reach and reach new customers.

Secure Transactions

We use industry-leading security practices to protect your data and transactions, including encryption, two-factor authentication, and fraud prevention measures.

Affiliation Program

Earn referral bonuses by adding new members to the community.

Gas Station

Merchants can partially eliminate gas fees on crypto transactions and increase their profits with the help of the gas station.

24/7 customer support

If you have any questions or problems setting up our service, our 24/7 customer support team is here to help.

Trusted by businesses of all sizes to enable growth.

If you are a business owner and interested in accepting cryptocurrency payments, check out XAIGATE and all the benefits that our service offers. From global customer outreach and multi-currencies compatibility to easy integration with multiple platforms, XAIGATE offers it all with an affordable price.

The Best Cryptocurrency Payment Gateway for Businesses of All Sizes

Why Businesses Choose XAIGATE

There are many reasons why businesses choose XAIGATE as their cryptocurrency payment gateway. Here are just a few:

- To increase sales: Accepting cryptocurrency payments can help businesses increase sales by attracting new customers and making it easier for existing customers to pay for goods and services.

- To expand their global reach: Cryptocurrency payments can be accepted from customers all over the world, which can help businesses expand their global reach and reach new customers.

- To reduce costs: Cryptocurrency payments are processed much faster than traditional payments, which can save businesses money on processing fees.

- To protect their business from fraud: XAIGATE uses advanced security measures to protect businesses from fraud and theft.

FAQ

Frequently Ask Questions

Empowering your business with the right tools for accepting crypto payments online and providing the best customer experience is crucial in today’s digital world.

Imagine a world where businesses can accept cryptocurrency payments from customers all over the world, instantly and securely, with minimal fees. That’s the world that XAIGATE is creating: Cheapest Crypto Payment Gateway.

How does a crypto payment gateway work? When a customer makes a cryptocurrency payment through a crypto payment gateway, the gateway converts the cryptocurrency into fiat currency and deposits the funds into the business's bank account.

One of the biggest risks associated with using a crypto payment gateway is the volatility of cryptocurrency prices. The value of cryptocurrency can fluctuate wildly, which means that businesses could lose money if the value of the cryptocurrency they accept declines.

Another risk to consider is the security of the crypto payment gateway itself. Businesses should make sure to choose a crypto payment gateway that has a good reputation and that uses robust security measures to protect customer data and transactions.

A crypto payment gateway is a service that allows businesses to accept cryptocurrency payments from customers. A crypto wallet is a software application that allows users to store and manage cryptocurrency.

Is cryptocurrency safe? Accepting cryptocurrency payments can be safe, but it is important to choose a reputable crypto payment gateway and to take steps to protect your business from fraud. For example, you should implement a strong password policy and enable two-factor authentication on your crypto payment gateway account.

Crypto payment gateways typically charge a fee for each transaction. The fee amount varies depending on the gateway and the type of cryptocurrency being used.

Crypto payment gateways are still in their early stages of development, but they have the potential to revolutionize the way that payments are made online. As cryptocurrency becomes more widely adopted, crypto payment gateways are likely to become more popular and sophisticated.